Three Ways to Evaluate Raising Existing Customer Rates

If there is one industry that has withstood, even excelled under pandemic conditions, it’s self-storage. Operators are experiencing record occupancy levels due to disruption driven by multiple economic factors. This includes employees working from home and needing home office space; businesses having to make room for social distance requirements; and unfortunately, many companies going under and needing somewhere to store equipment, fixtures, and other furnishings.

As a result, move-ins are higher, and move-outs are lower than seasonally expected. This allows increased street rates (that is, new customer rates) to be significantly higher across the board. Prorize is pushing street rates for our clients to record highs, sometimes exceeding 50 percent year-over-year, and still observing strong move-ins while maintaining record occupancy levels.

Lower move-outs result in higher lengths of stays, leading to more long-term tenants being eligible for rent increases. The risk of move-outs is also lower as new customer demand is strong with higher street rates at lower promotional expenses. This presents significant opportunities for growing your company’s revenue by effectively raising existing customer rates.

Here are three areas self-storage operators should consider when it comes to raising existing customer rates.

1. How to Time Rent Increases

To understand when to raise rents and how this impacts your business, we recommend move-out propensity analysis by length of stay (LOS). This analysis allows operators to understand the ideal point at which to raise rents and gain additional revenue.

For example, the LOS analysis show that move-out churn is higher for customers with shorter lengths of stay. By applying a first-time rent increase on, say, month six instead of month seven, you can capture additional revenue that would have otherwise been lost from customers that were already planning on moving out on month seven. Yes, it’s just one month, but one month over thousands of customers adds up over time. Of course, this strategy needs to be evaluated with expected revenue considering the additional move-outs you would observe by raising rents a month earlier.

In addition, those customers paying significantly lower than the current street rates could become eligible earlier. The frequency of subsequent rent increases also could be similarly determined.

2. Determine a Customer’s Propensity to Move Out

The key aspect of optimally raising customer rates is to be able to measure a customer’s tendency to move out as a function of a price increase. You establish this by comparing two customer segments (“eligible” customers that got a rent increase and “baseline” customers that did not get a rent increase) during the same period. The difference in move-out percentage, along with the difference in revenue between the eligible and baseline customer segments, allows you to estimate the revenue opportunity in raising existing customer rents.

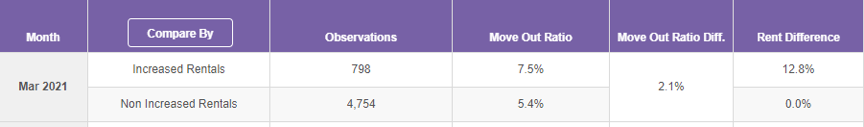

Let’s take a look at the example below. Effective March 2021, a group of eligible customers pays 12.8 percent higher rents and has a move-out ratio of 7.5%. A comparable baseline group of customers did not receive any rent increases, and their move-out ratio is 5.4%. As a result, we have a 2.1% higher propensity to move out for eligible customers, which must be used to optimize the revenue opportunity for rent increases.

One relevant question is how we define eligible and baseline customer segments for comparison.

3. Understand Your Customer Behavior

Through customer data analyses, we’ve uncovered many components that determine how sensitive a customer is to a rent increase. While components vary based on the local market conditions, we derived the following conclusions from our analysis of thousands of stores.

- Commercial vs. Individual – Individual customers have 4.8 percent higher move-outs as compared to their baseline group after an increase, while commercial customers have 4.0 percent more move-outs. Commercial customers are less sensitive to rent increases.

- Customer’s current length of stay – Customers with less than 12-month stays have 5.0 percent more move-outs after an increase, while customers with greater than 24-month stays have 2.5 percent more move-outs. The longer you retain a customer, the less sensitive they are to rent increases.

- Autopay vs. manual pay – Manual-pay customers have 7.1 percent more move-outs after an increase, while auto-pay customers have 3.8 percent more move-outs. Auto-pay customers are significantly less price-sensitive to rent increases.

Other factors also impact the existing customer rent increase process, including, but not limited to: season, demand forecasts, number of units a customer is renting, and the distance between where they store vs. where they live.

The bottom line: Don’t be afraid of raising existing customer rates. Not all your existing customers will respond to a rent increase similarly, so you must look at your data to uncover the differences among your customer segments and maximize long-term revenue.